Attn: Singaporeans Looking To Grow Your Net Worth 2-4X Safely With Proven Records In This Uncertain World in 2024

Dear Singaporeans,

Are you confused about what’s happening in the world right now?

Stock market goes up and down and you are finding the right way to navigate through the noise.

I’ve been investing for many decades and I’ve observed multiple crisis, since 1997 Asian Financial Crisis, 911, SARS, Global Financial Crisis, Covid-19 till today Ukraine-Russia war.

Throughout the decade, I’ve observed some Singaporeans manage to live a good life and retire for the rest of their lives because of good decisions they have made.

And I’ve decided to compile all my years of experiences and send you what I’ve learnt so far.

I am willing to share all these for free, because I work with clients who are serious about financial planning and they have found it useful.

Throughout the decade, I’ve observed some Singaporeans manage to live a good life and retire for the rest of their lives because of good decisions they have made.

And I’ve decided to compile all my years of experiences and send you what I’ve learnt so far.

I am willing to share all these for free, because I work with clients who are serious about financial planning and they have found it useful.

I’ve been in the finance space for the past 15 years and I’ve observed multiple crisis, since 1997 Asian Financial Crisis, SARS, Covid-19 till today Ukraine-Russia war.

Throughout the decade, I’ve observed some Singaporeans manage to live a good life and retire for the rest of their lives because of good decisions they have made.

And I’ve decided to compile all my years of experiences and send you what I’ve learnt so far.

I am willing to share all these for free, because I work with clients who are serious about financial planning and they have found it useful.

I can guarantee you that people are charging pennies and dollars for this knowledge.

Courses will charge you $297, $997, or even more…

Where on my end I just need your time commitment to read the following below.

Who is it for?

- Professionals Fetching Above $5K Income Monthly

-

Burnt In Financial Markets or Someone Looking For Safe & Predictable Returns

-

Singaporeans Who Want To Beat Inflation or Get Returns Better Than Bank Without Losing Their Cash

- Those who wants their money to sit their bank and not let it compound over years

- Not willing to hear out effective methods that will get you results more than putting it in Fixed Deposits

Here’s What I Have Compiled For You…

1

How to COMPOUND your net worth by 2-4X safely, predictably and effectively…

2

The Top 2 Retirement Methods You Need to Live a Great Life and Retire Immediately

3

Why Singaporeans lose money and how you can Grow, Preserve and Hedge your money with my tips

4

Discover what and how to invest now to get consistent returns every single year above market average

5

Biggest mistakes to avoid making in your finance to prevent setback in your retirement years

How to RETIRE in next 3, 5 or 10 years REALISTICALLY

7

CPF Tips & Tricks That Will Help You To Grow your CPF Balance

8

Why you SHOULDN’T buy active managed funds (COMMON mistakes most people make)

9

Creating Your Own Payout Portfolio That Pays You Monthly

Before you move on… WHO AM I?

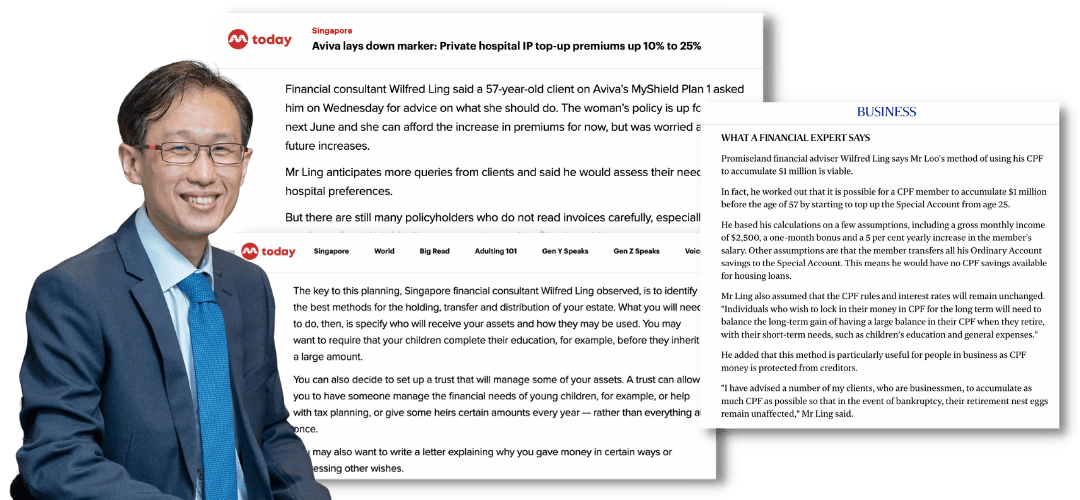

Hi, I'm Wilfred Ling

I am the Wealth Advisory Director with Financial Alliance and have been in this profession for 16 years.

I have served many professionals all over the world and currently I manage more than $30 million of my clients’ investments as of 2023.

I have helped many of my clients of mine reduce their retirement age by 10 years, achieve their dreams of having multiple properties and thus allowing my clients to focus on what they really care about.

I work 1000% harder than my peers because by helping people retire earlier, I will have more friends who are retirees.

Featured On

Reviews From My Clients From All Walks Of Life

These are the attendees from past webinars…

“Client invested in Novocure stocks and managed to get at least 100% return.

Upon my advice, they bought the stock at $82 USD on 17 Dec 2019.

They sold at the price on 30th January 2021 at $160 USD.”

You too, can get the same results!

In fact, the starting cost for you will be

$0! Zero!

I’m giving away the tips and 16 years of knowledge for free.

You won’t be able to get this anywhere else.

Lastly, Let Me Show You My Experiences With My Clients…

Dr Sloan Kulper & Ms Tsui Gah Yee

"As an international couple, we were looking for a advisor who could help us put together a tailor-made retirement plan that fits our somewhat complicated cross-border financial picture. Wilfred Ling is just that person: a patient and caring partner who takes the time to understand our needs and create a plan we are comfortable with in the long term."

Mr & Mrs Teo Boon Keng

"Before we met Wilfred, none of the advisers I met were able to provide a holistic analysis of our financial health and able to address both short-term and long-term retirement goals.

I would recommend Wilfred because he is professional and objective. He is sharp and clear in his explanations and advice. Moreover, he is highly meticulous in his analysis and recommendations. He reminds us to focus on our long term goals and guides us in seeing the big picture to enable us to make better decisions."

Dr Jason Tang & Dr Fiona Chang

"Wilfred has been most patient and candid in his explanation to us. We started off with financial planning exercise to understand currently how we are doing financially and what plans we should be making for retirement. Then we move on to reviewing our then insurance plans. With Wilfred on our backs, we are definitely more confident on how our finances are managed and feel safer that our insurance needs are adequately met."

Now, shall I bring you onboard to show you how you can safely, predictably and effectively compound your net worth like them above?

Now, shall I bring you onboard to show you how you can safely, predictably and effectively compound your net worth like them above?

Now, shall I bring you onboard to show you how you can safely, predictably and effectively compound your net worth like them above?

Now, shall I bring you onboard to show you how you can safely, predictably and effectively compound your net worth like them above?

What's Included:

One tip will be unlocked everyday!

Copyright © 2022 - Wilfred Ling